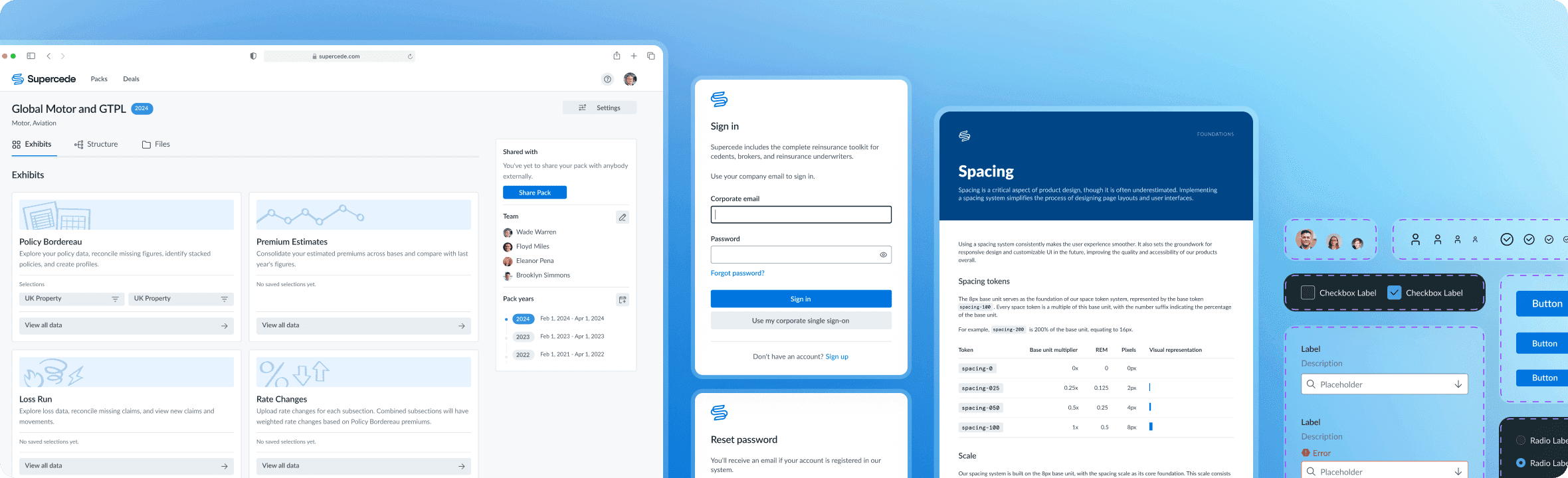

Supercede — product design for the digital ecosystem for the reinsurance market

I was an early team member and a founding designer at a leading InsurTech startup that raised over $20 million in funding. Led product design efforts to transform insurance data storage, analysis, and reinsurance placement, aiming to bring a seamless digital trading experience.

A few words about Reinsurance

Insurance companies also purchase insurance to protect themselves from significant claims event risk. Imagine this: an insurance company sells a million car coverage policies, but then a tsunami destroys most of those cars. The company might not have enough funds to cover all the losses. That's where reinsurance steps in. If something big happens, it spreads the risk so that the cost gets shared among many companies.

Insurance is a critical piece of the global financial fabric, ensuring stable trading, transportation, healthcare, etc. In turn, reinsurance is the foundation of insurance. However, the industry is hugely outdated, struggling with poor data quality, and delays in placements, resulting in unpreparedness for new challenges like cyber security risks, etc.

Glossary (client / user types)

Cedent

The primary insurance company transferring risk to a reinsurer.

Broker

An intermediary facilitating reinsurance transactions between parties.

Reinsurer (underwriter)

Assumes some risks transferred by the cedent in exchange for premiums.

Company & Product

Supercede (originally Riskbook) was founded in 2019 by industry experts who keenly grasped the sector’s challenges and opportunities. I became the startup’s early employee (#6) and founding designer that same year. Since its inception, the company has operated entirely remotely.

The platform houses tools that can be used by one or more parties during a reinsurance transaction. These tools focus on the two areas that cause the most friction in this process:

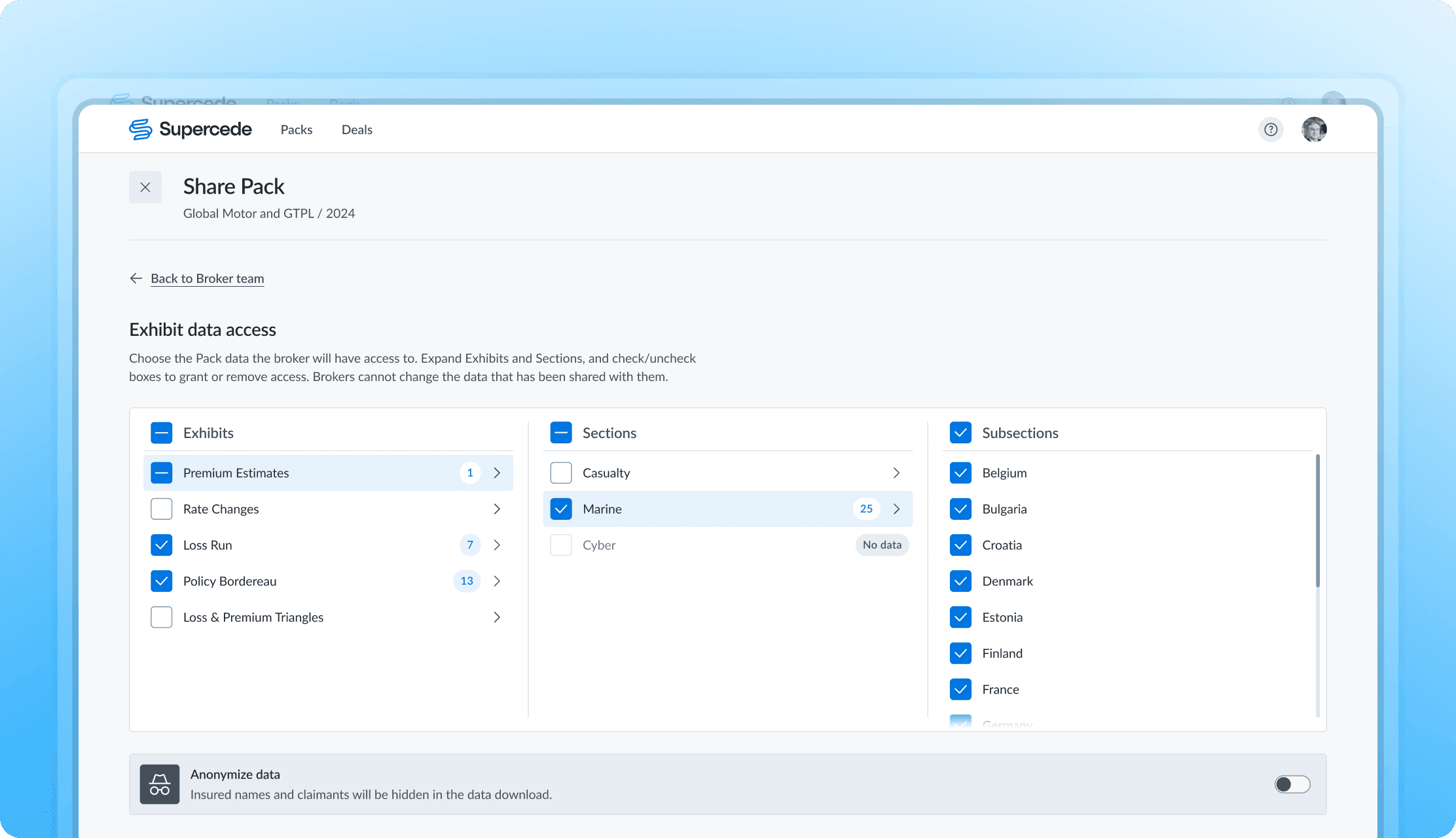

Packs

Preparation, validation, and sharing of underlying submission data.

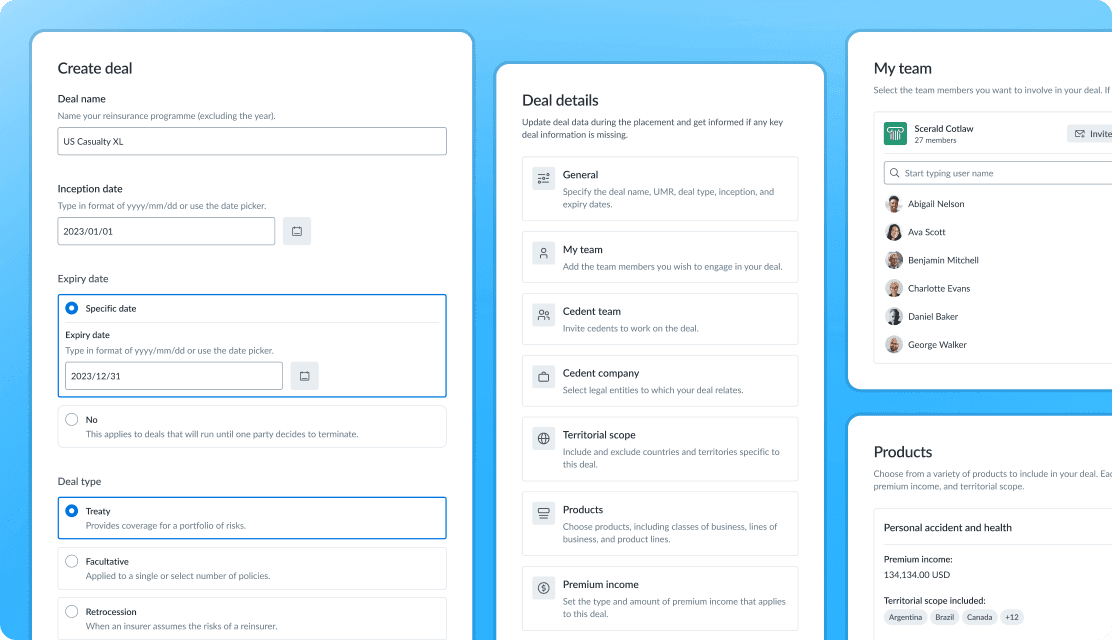

Deals

Preparation, quoting, and binding of reinsurance transactions.

Packs

The reinsurance industry revolves around transferring data from one party to another. This collection of data is usually called a pack. Packs provide the essential details that enable cedents, brokers, and reinsurers to price their reinsurance.

Case studies

Deals

Brokers commonly place reinsurance contracts between the cedent (buyer) and the reinsurer (seller). This process occurs over several months and involves endless emails, meetings, and phone calls. The aim was to digitalize the process, creating an intuitive UX that cuts down on the back-and-forth and streamlines it.